To meet the world’s need for materials and industrial goods, manufacturing must reinvent itself through innovation, digitisation and automation.

How we make

An epochal transformation of manufacturing is underway

In the Fourth Industrial Revolution, manufacturers are a beacon of innovation - embracing the use of such as automation, 3D printing and AI to boost their productivity, efficiency and agility. Companies - for example within wholesale, agriculture, mining and technical services, together forming the Make domain - are already using these advances to reinvent themselves. As a result of these efforts, up to US$1.8 trillion of manufacturing revenues could be redistributed in 2025.

Other powerful catalysts include the need to insulate supply chains from climate shocks, the push to improve sustainability and circularity, the growing demand for workers with specialised skills, and the impact of geopolitical tensions on trade routes. Together, they’re combining to forge a major sectoral reconfiguration in manufacturing.

Dutch manufacturing industry as a driver of productivity

The manufacturing industry forms the backbone of the Dutch economy and is synonymous with high-quality employment and innovation. It stands out for exceptional productivity per employee, with these jobs being significantly better paid than in other sectors. Digitalisation and technological progress offer enormous opportunities for innovation and efficiency improvements, while the shift towards sustainable production processes favours Dutch pioneers in green technologies.

At the same time, global trade conflicts, fluctuating raw material prices and the shortage of highly skilled workers present challenges that require a strategic approach. Rapid technological change demands continuous adaptation from companies to remain competitive. Dutch manufacturing firms navigate this dynamic environment through substantial investments in R&D, with their globally respected products contributing to a strong Dutch export position and a positive trade balance.

‘The Dutch manufacturing industry is a productivity engine that contributes to high-quality employment and economic resilience – by turning challenges into opportunities for innovation, we remain competitive worldwide.’

Capturing the value in the decade ahead

Businesses that grasp the full potential of the Make domain will have the edge in 2035.

The extent of that growth will depend on how megatrends play out.

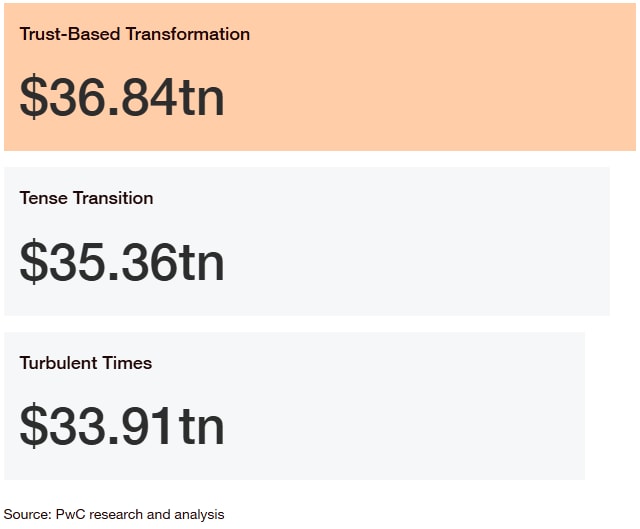

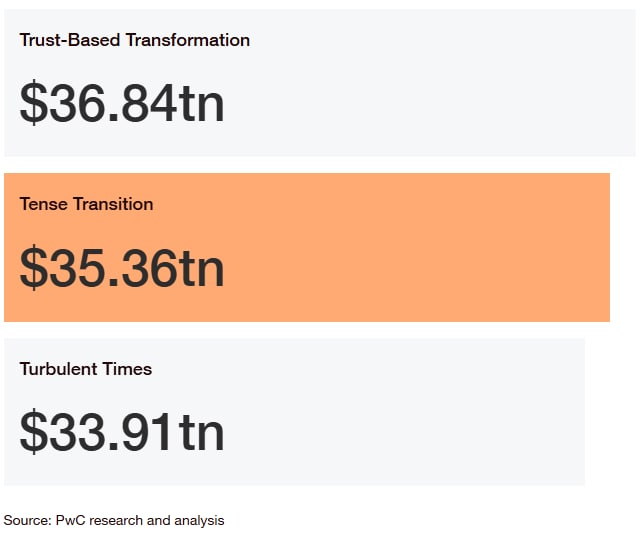

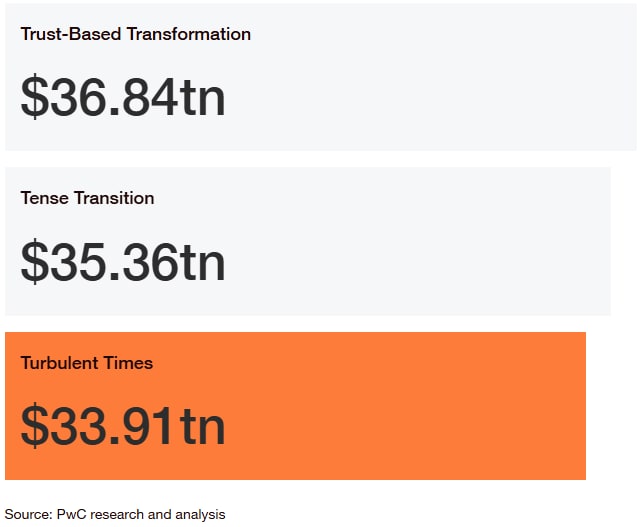

To obtain a quantitative picture of what the Make domain might look like in 2035, we modelled the potential global economic impact of two of the most pressing megatrends: technological disruption (specifically disruption from AI) and climate change. The result is three divergent scenarios, corresponding to a range of outcomes, from a low of $33.91 trillion to a high of $36.84 trillion.

Sizing the Make opportunity

The nature and scale of the new business opportunities that emerge in the Make domain will depend on how AI adoption and climate action progress. Your strategy should account for a range of possible outcomes. Three scenarios can help leaders in the Make domain consider what the future might bring.

Learn more about the three divergent tomorrows

To reinvent for multiple tomorrows, take action today

The process of reinvention needs to start now, with a focus on priorities that respond to the reconfiguration that’s already underway. This means driving hard towards a set of innovation imperatives, securing competitive advantages in areas such as technology and trust, and turning obstacles such as climate threats into enablers of growth.

How to win in the Make domain

Explore all new domains

Select from the nine domains below to learn how they are forming, the size of the opportunity and how to seize the value in motion.

Contact us

Industry Leader Industrials & Services, PwC Netherlands

Tel: +31 (0)62 233 25 30