To ensure clean and reliable access for a rising population and enable industries to meet demand, the energy sector must embrace new ways of operating.

How we fuel and power

The industries that enable global progress are transforming

The long-established value chains that transform fossil fuels into electrons and molecules that fuel our world still define the global energy industry. But the system is rapidly evolving, as climate change forces a fundamental rethink—and technological innovations create new opportunities.

As it shifts to incorporate more zero-carbon electricity and new low- and no-carbon fuels, the energy system must ensure reliable access to energy for a growing global population, and low-cost power sources to enable industries to meet rising living standards. Critical sectors such as steel, chemicals, fertiliser and plastics drive demand for fossil fuels. Investment is climbing in companies working on alternative fuels; power storage; transmission infrastructure; and new technology, such as AI and analytics, that can identify and drive efficiency.

The value of the Fuel and Power domain is projected to reach US$6.19 trillion by 2035.

As supply and demand for vital resources grow, value will be created in fundamentally different ways. AI, which will increase electricity demand, can be deployed to help manage grids, drive efficiency and lower costs simultaneously. Other modes of value creation that are nascent today, such as sustainable fuels and green hydrogen, will need to scale dramatically.

Energy transition accelerates through Dutch expertise

The Netherlands stands at the forefront of Europe's energy transformation, combining ambitious climate targets with world-class innovation. As a frontrunner in offshore wind development, the country is building hydrogen infrastructure, advancing carbon capture technologies, and deploying smart grid solutions that set global standards. Dutch expertise in energy innovation positions the nation as both a leader and essential partner in the international energy transition.

Yet this leadership comes with complex challenges. Grid congestion, surging electricity demand, and the costs of system transformation require strategic thinking and bold action. Through collaborative ecosystems involving grid operators, innovative industry players, and forward-thinking government policy, the Netherlands is pioneering solutions that balance sustainability with reliability. From small modular reactors to advanced solar technologies and large-scale battery storage, Dutch innovation is creating the flexible energy systems of tomorrow—so you can build an energy future that works for everyone.

'The Netherlands isn't just adapting to the energy transition, we're architecting it. By combining our engineering excellence with strategic partnerships, we're creating energy solutions that deliver both sustainability and security on a global scale.'

Capturing the value in the decade ahead

Businesses that grasp the full potential of the Fuel and Power domain will have the edge in 2035.

The extent of that growth will depend on how megatrends play out.

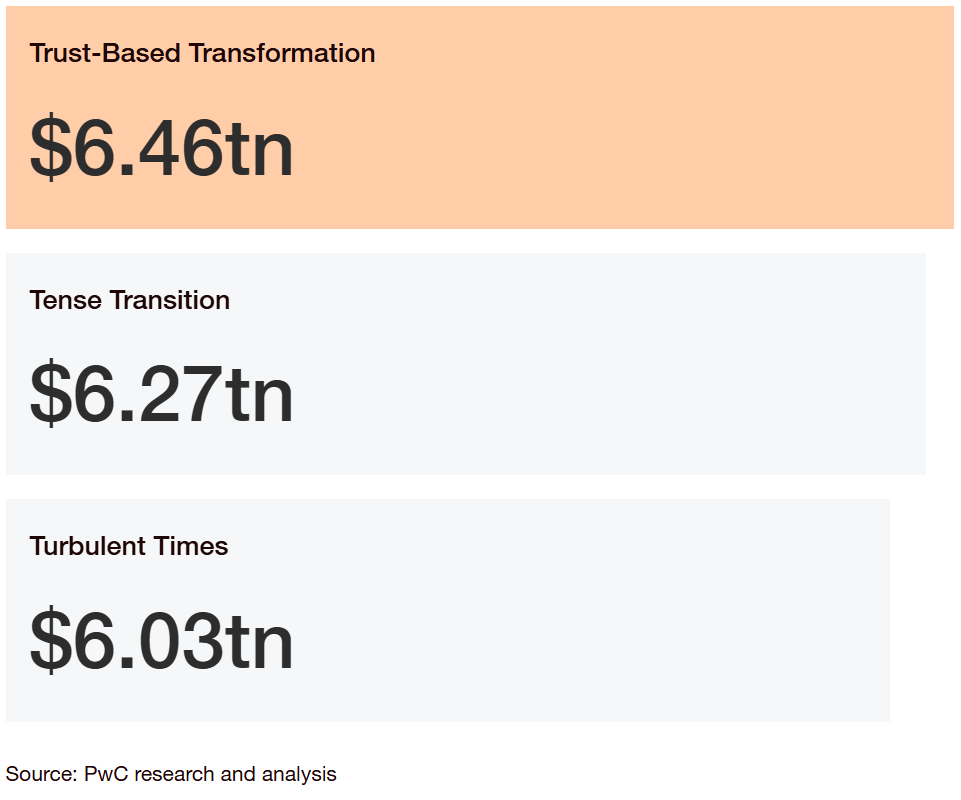

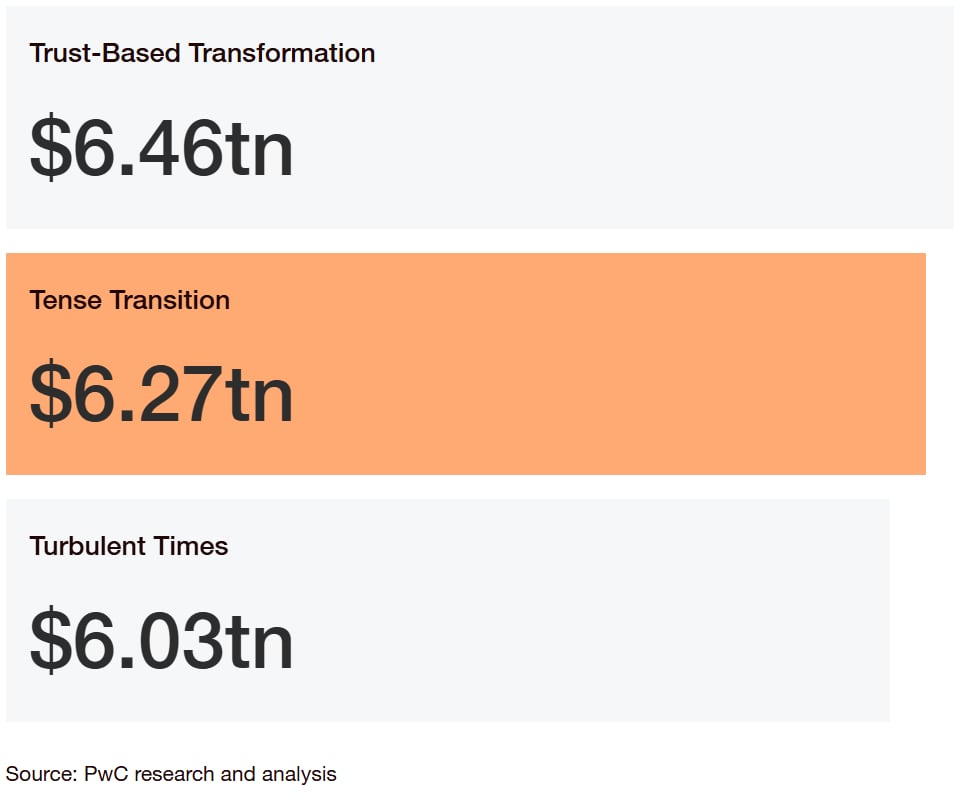

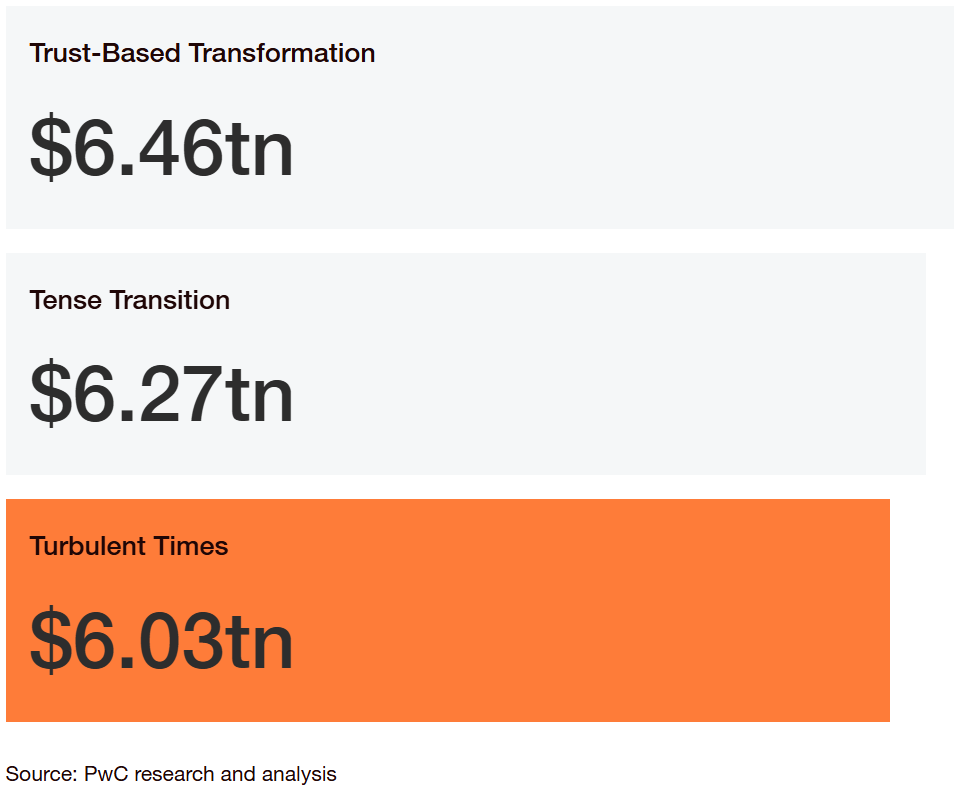

To paint a quantitative picture of the future, we modelled the Fuel and Power domain’s growth under three divergent scenarios, focusing in particular on the impact of technological disruption, specifically from AI, and climate change. Depending on the assumptions, the size of the domain in 2035 could range from a low of $6.03 trillion to a high of $6.46 trillion.

Sizing the Fuel and Power opportunity

The nature and scale of the new business opportunities that emerge in the Fuel and Power domain will depend on how AI adoption and climate action progress. Your strategy should account for a range of possible outcomes. Three scenarios can help leaders in the Fuel and Power domain consider what the future might bring.

Learn more about the three divergent tomorrows

To reinvent for multiple tomorrows, take action today

The process of reinvention needs to start now, with a focus on priorities that respond to the reconfiguration that’s already underway. This means driving hard towards a set of innovation imperatives, securing competitive advantages in areas such as technology and trust, and turning obstacles such as climate threats into enablers of growth.

How to win in the Fuel and Power domain

Explore all new domains

Select from the nine domains below to learn how they are forming, the size of the opportunity and how to seize the value in motion.

Contact us

Energy - Utilities - Resources Industry Leader, PwC Netherlands

Tel: +31 (0)61 003 87 14