{{item.title}}

{{item.text}}

{{item.text}}

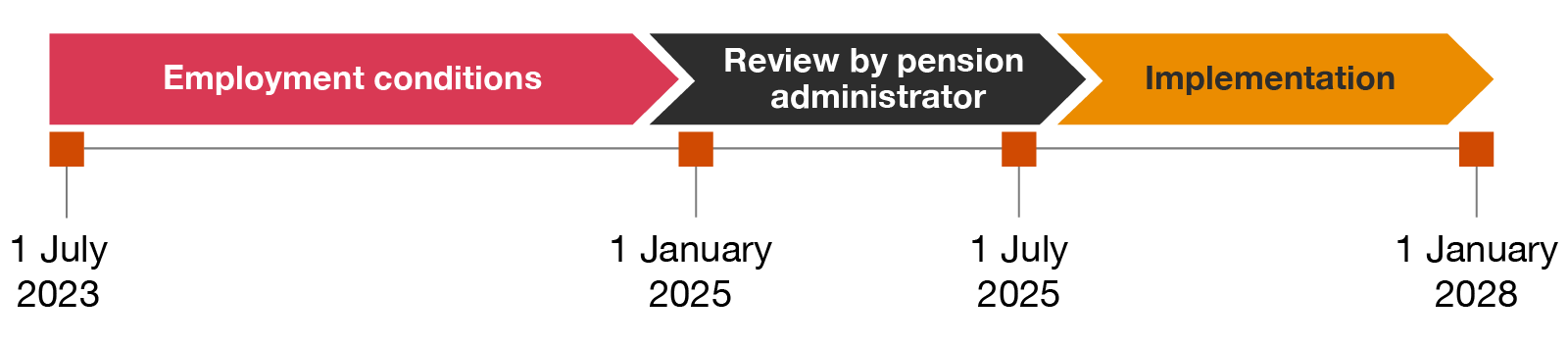

The Future Pensions Act (Wtp) forces every employer to think about the future pension agreement with its employees. The transition to defined contribution agreements with age-independent flat premiums means that almost all pension schemes will have to be changed in the coming period. This has implications for both employers and pension administration organisations and funds. With both knowledge of laws and regulations and technological know-how, we are able to guide you across the spectrum, depending on your needs.

The change to the pension system affects both older and younger employees, requiring them to be compensated ‘adequately’ in case of a decline. Employers with a pension scheme with a pension fund could use pension assets to offset some or all of the negative effects of the changes. Employers with a pension scheme with a Premium Pension Institution (PPI) or insurer do not have that option. They have to compensate employees themselves for the negative impact. This compensation is likely to lead to a (temporary) increase in the required pension budget.

In addition, the survivors’ pension will also be significantly changed in the new pension system. Because of the unification of the partner definition, it will soon be clearer for partners whether they are considered partners in the pension scheme. In addition, employers can only insure the partner’s pension in case of death before the retirement date on a risk basis.

Employers can best consider the challenges of the Wtp in conjunction with the overall remuneration strategy. This helps to keep a lid on cost increases and enhance employee appreciation of working conditions. With our integrated approach, our focus on cooperation and using specially developed digital solutions, we guide employers step by step towards a new pension scheme based on the right facts. We understand that there is no single solution when it comes to aligning the pension and benefits package with the HR strategy.

The Wtp presents pension providers and administration organisations with a strategic choice: do we transform the organisation ‘only’ to comply with the requirements of the Wtp (‘comply only’) or do we also want to differentiate ourselves from others in the pension sector with a view to making the pension market more transparent and individual (‘comply and differentiate’)? They will also have to take into account new duties such as ‘choice guidance’ and ‘encouraging active engagement’ in the new system. However, before that happens, a large proportion of pension funds will have to convert current pension entitlements. The pension fund and the pension administrator play important roles in this process. To make sure this transition to the new pension scheme is carried out correctly, it is important for the data to be in order and thus ready for transition. In this way all participants in the new pension scheme get what they are entitled to and unnecessary mistakes are avoided. A sound IT strategy is ‘key’ in this respect.

The Wtp represents a huge transformation of our pension system. Almost all organisations will have to adapt their pension scheme, its funding and their (core) administration systems to the new legislation. Both employers and pension administrators face major challenges, in which it will sometimes be difficult to maintain oversight. With our integrated approach, our focus on cooperation and using specially developed digital solutions, we guide you, based on the right facts, step by step to a future-proof pension scheme and/or administration. If you would like more information, don’t hesitate to contact us.

{{item.text}}

{{item.text}}