Business collaboration increasingly runs on technology. And the businesses developing that technology must increasingly collaborate to thrive.

How we connect and compute

More than any other megatrend, technological disruption drives cross-sector collaboration

Industry 4.0. Precision agriculture. Autonomous vehicles. Algorithmic drug discovery. These are just some of the innovations that companies have developed by layering massive computing power and widespread connectivity into their business models to access fresh sources of value.

What’s striking about these innovations is their combinatorial nature. Businesses are bringing together technologies, from semiconductors to satellites, with concepts from different industries to create seamless customer offerings. In this way, advances in tech not only spur collaboration and invention, they also catalyse the formation of economic domains centred on humanity’s changing needs. And as generative AI makes it ever easier for people to extract useful insights from messy stores of data and bring new ideas to life, the pace of co-creation is bound to pick up.

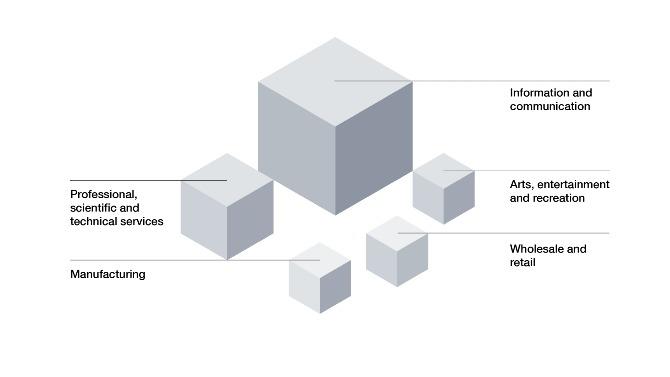

In the Connect and Compute domain, businesses converge to meet tech needs.

The diverse organisations operating within the Connect and Compute domain will create greater value through intensive collaboration with companies across domains. We already see this happening. Big tech platform providers are joining with investors, governments, energy companies and construction firms to set up powerful data centres that will extend AI capabilities to all segments of the economy. Semiconductor suppliers are going beyond provisioning chips by partnering with customers in Care, Make and other domains to co-develop software and algorithms for industry-specific purposes.

The reconfiguration of industries presents the Connect and Compute domain with nearly endless opportunities. They could spark the next wave of growth telcos have been seeking and expand a tech market already projected to grow. However, megatrends will greatly influence how much this domain adds to the global economy.

Dutch companies play a major role

With major players in the technology sector, the Netherlands is an important hub in the Connect and Compute domain. Chips are the new oil of our economy, and companies such as ASML and NXP largely determine the developments in this area.

These developments have an impact on almost all sectors, including in the Netherlands. Within the Connect and Compute domain, knowledge and expertise can come together to further enable digitalisation and the use of AI in other Dutch sectors. In a cost-effective, energy-friendly, and secure manner. This movement is already visible in various Dutch companies. For example, the port of Rotterdam is establishing its own Private 5G network for its terminal users.

Capturing the value in the decade ahead

Businesses that grasp the full potential of the Connect and Compute domain will have the edge in 2035.

The extent of that growth will depend on how megatrends play out.

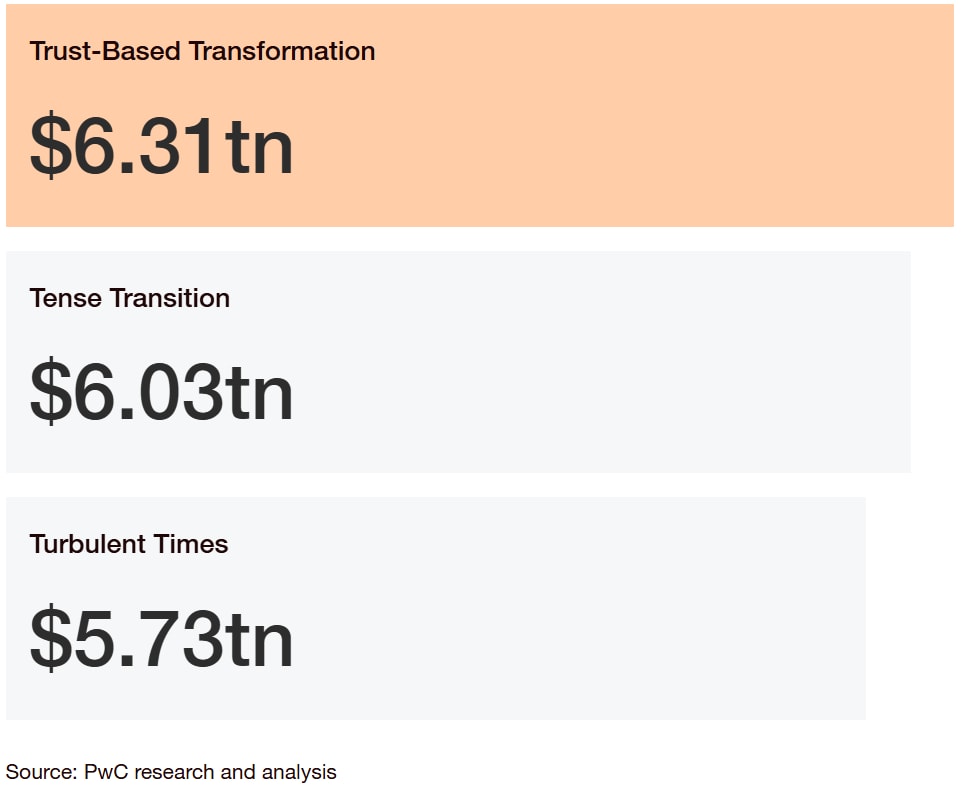

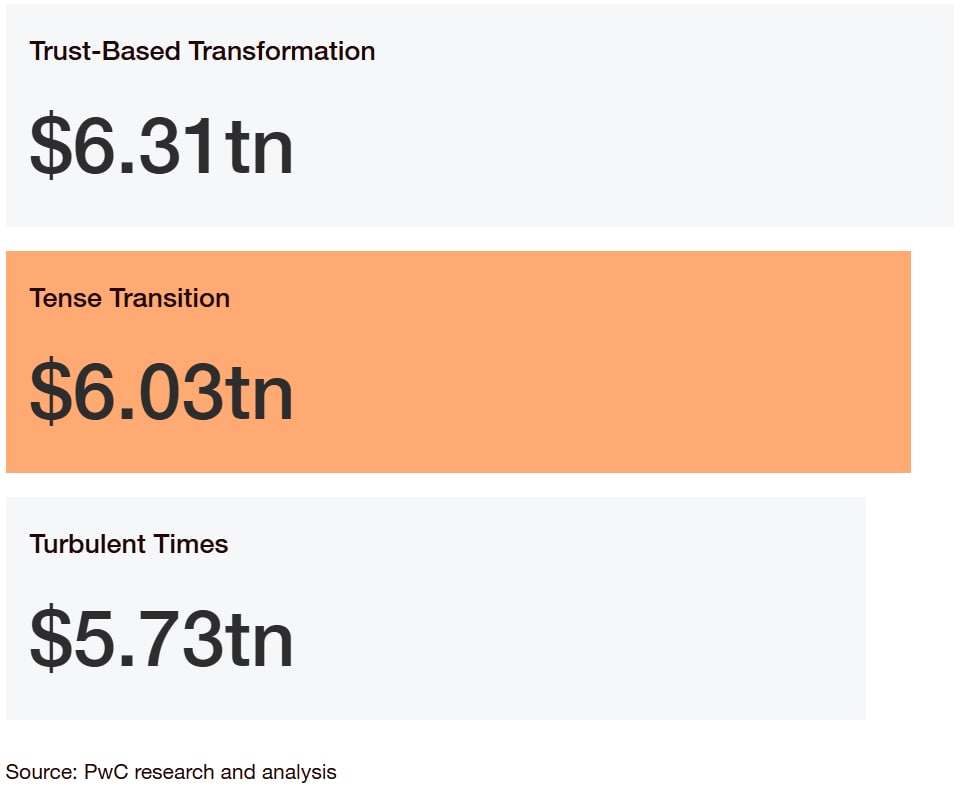

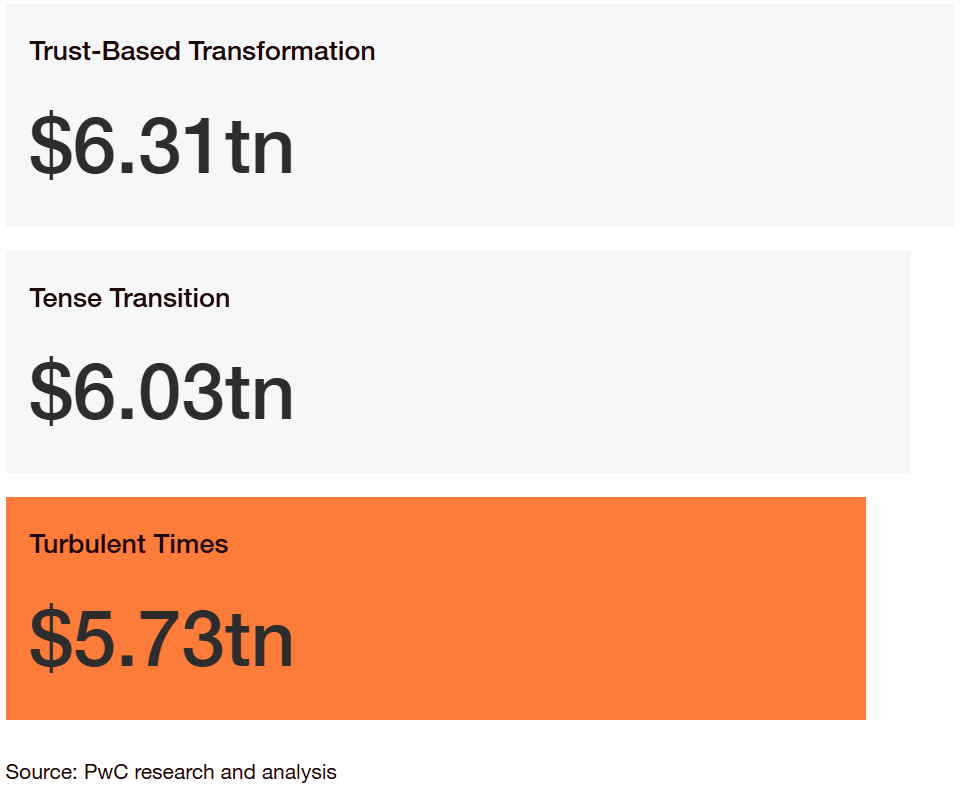

We explored three potential ways that the most pressing of these trends—climate change and technological disruption—could unfold over the next ten years. Our modelling shows they could push the Connect and Compute domain’s contribution to global GDP as much as 9.5% higher or 0.5% lower than the baseline scenario by 2035.

Sizing the Connect and Compute opportunity

The nature and scale of the new business opportunities that emerge in the Connect and Compute domain will depend on how AI adoption and climate action progress. Your strategy should account for a range of possible outcomes.

Learn more about the three divergent tomorrows

To reinvent for multiple tomorrows, take action today

The process of reinvention needs to start now, with a focus on priorities that respond to the reconfiguration that’s already underway. This means driving hard towards a set of innovation imperatives, securing competitive advantages in areas such as technology and trust, and turning obstacles such as climate threats into enablers of growth.

How to win in the Connect & compute domain

Explore all new domains

Select from the nine domains below to learn how they are forming, the size of the opportunity and how to seize the value in motion.

Contact us