Capital is a vital catalyst for growth. How it’s deployed, managed and insured must evolve along with the industries it serves.

How we fund and insure

As industries change, so do the opportunities for companies that finance them

Change is afoot. Industries are reorganising around human needs—to get around, to build spaces for living and working, to care for our health. Established businesses and new ventures alike are creating value in innovative ways; they’re working across sector boundaries to combine diverse ideas and capabilities into offerings for the growing needs-centred domains of the economy.

This flurry of industry reconfiguration is providing new opportunities for the financial sector, too. As a critical enabler of other domains, the Fund and Insure domain is fertile ground for cross-sector collaboration among non-traditional partners, providing them with new, more efficient models for capital allocation and financial services. Inventing such models means rethinking not only how and where capital is deployed, but who deploys it—and conceiving of capital allocation as a domain of growth unto itself.

Financial institutions can reinvent themselves within the shifting economic landscape.

As companies evolve within domains, institutions in capital markets, as well as private equity and other investors, stand to gain by applying novel approaches to risk, valuation and portfolio management. Winning companies will reimagine their roles as allocators of capital, much as traditional banks did a decade ago, when insurers, asset managers, tech giants and others began offering private credit. The redistribution of market share in financial services will be significant: we estimate that US$604 billion could change hands in 2025 as a result of redefinition moves by institutions in the banking and capital markets, insurance, and wealth management sectors.

Dutch financial sector strengthens position

Dutch banks, insurers and pension funds have significantly strengthened their resilience through higher capital ratios and improved risk management. This solid foundation positions the sector strategically for the next growth phase, where digitalisation and innovation fundamentally redefine service delivery. From generative AI that accelerates processes to hyperpersonalisation that transforms client interactions, Dutch financial institutions harness technology to meet rising expectations for digital, swift and flawless service provision.

Simultaneously, new opportunities emerge through growing private equity and private credit markets, whilst digital assets such as crypto and stablecoins become integrated into payment and investment systems. MiCA regulation and tokenisation of real-world assets open doors for innovative revenue models. Although geopolitical tensions and market volatility present challenges, Dutch financial institutions investing now in technology, sustainability and robust risk management determine the sector's future—so you can build upon a financial ecosystem that works for everyone.

"Through digitalisation and new technologies, unprecedented opportunities arise for efficiency and groundbreaking business models that shape tomorrow's financial services."

Capturing the value in the decade ahead

Businesses that grasp the full potential of the Fund and Insure domain will have the edge in 2035.

The extent of that growth will depend on how megatrends play out.

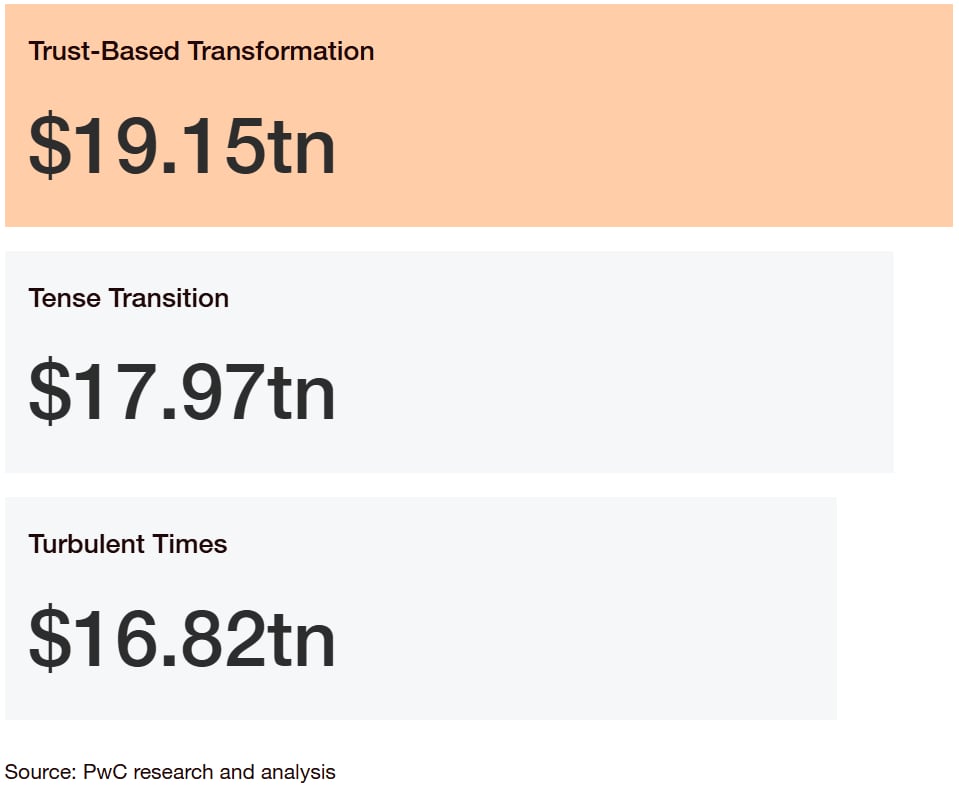

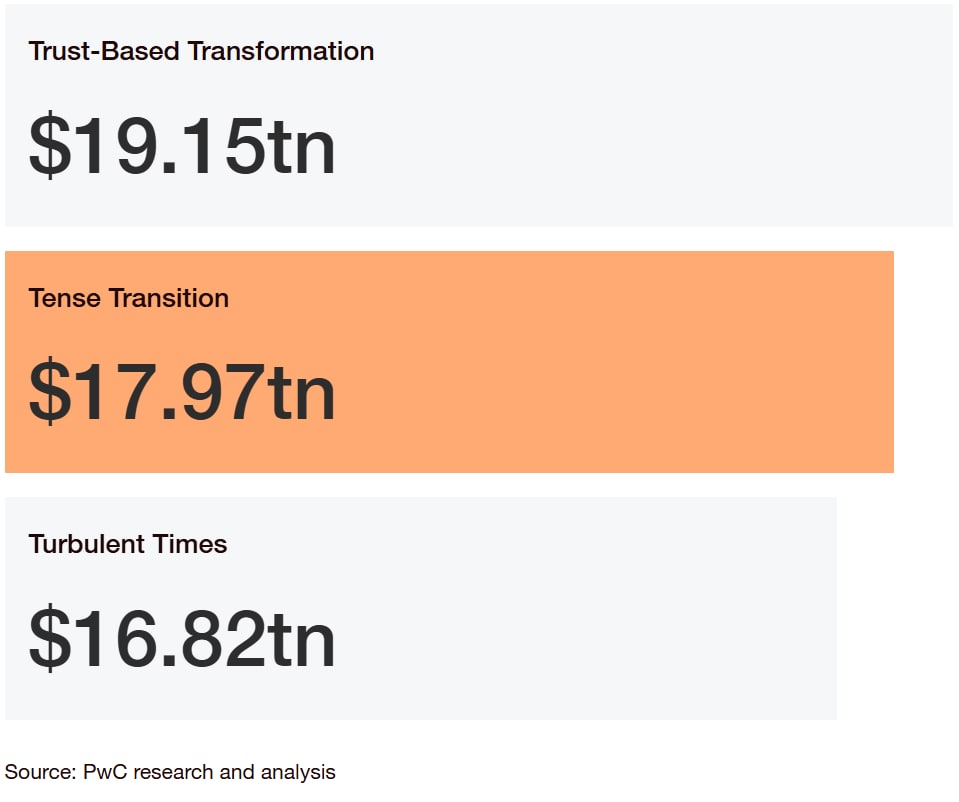

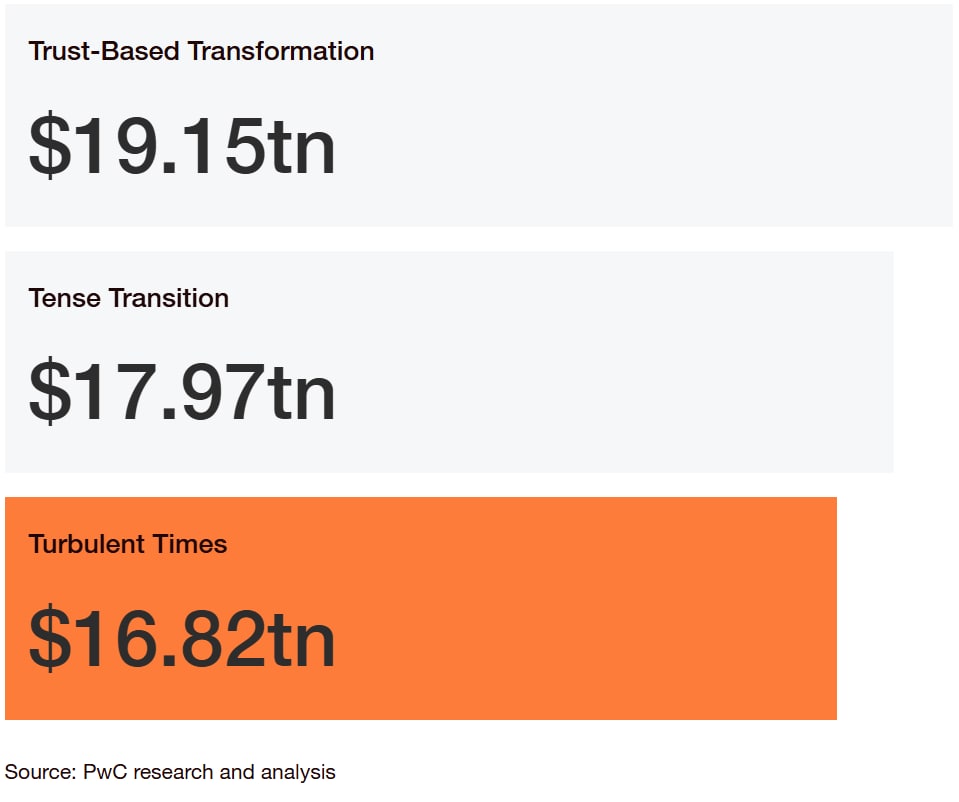

To help the sector envision the possibilities, we modelled the Fund and Insure domain’s growth through 2035, while accounting for the impact of climate and tech disruptions. The result is a range of three potential scenarios, spanning a low of 1.3 per cent below baseline and a high of 12.4 per cent above.

Sizing the Fund and Insure opportunity

The nature and scale of the new business opportunities that emerge in the Fund and Insure domain will depend on the way and speed of AI adoption, climate action progress and the assessment of risks. For their strategy institutions and companies should account for a range of possible outcomes.

Learn more about the three divergent tomorrows

To reinvent for multiple tomorrows, take action today

The process of reinvention needs to start now, with a focus on priorities that respond to the reconfiguration that’s already underway. This means driving hard towards a set of innovation imperatives, securing competitive advantages in areas such as technology and trust, and turning obstacles such as climate threats into enablers of growth.

How to win in the Fund and Insure domain

Explore all new domains

Select from the nine domains below to learn how they are forming, the size of the opportunity and how to seize the value in motion.

Contact us