The agri-food system is at a pivot point. Feeding 10 billion people at mid-century will require a cross-sector push for innovation in the decade ahead.

How we feed ourselves

The food system must be reconfigured to deliver abundance, resilience and sustainability

Today’s food system is a complex global network: farmers produce, traders distribute, manufacturers process, retailers sell, and the public sector supports and regulates to make food available daily. It’s also a system under pressure. Climate perils such as drought and heat stress threaten crops. The scarcity of water, arable land and other key resources is mounting. Food waste and loss eliminate one-third of what is produced for people to eat. All of these will be critical challenges as the global population nears 10 billion in 2050.

The answers to many of the challenges facing our food system will come from collaborative innovation. We must simultaneously scale technology, engage in sustainable intensification of farming; reduce waste and make processing more efficient; and adapt to healthier, eco-conscious diets. Above all, we’ll need to mitigate the impacts of climate and weather volatility on the food supply.

Some shifts towards a healthier, more sustainable and efficient food system are already underway: companies are ramping up efforts to reinvent their business models. In the accommodation and food services sector, we expect such efforts will cause US$188 billion of revenue to move among companies in 2025.

Driving Dutch innovation and impact in food systems

Dutch food and beverage businesses are exceptionally well positioned to lead the global transformation of food systems with resilience and innovation. By combining world-class agri-food science, cutting-edge ingredient development and data-driven retail expertise, Dutch enterprises deliver resilient, healthy diets at competitive prices. As cost pressures, climate change and geopolitics reshape demand worldwide, the Netherlands' unique ecosystem of growers, manufacturers, retailers and technology firms drives collaborative innovation across the entire value chain.

The next wave of growth emerges from scaling affordable plant-forward and ready-to-eat options, deploying AI to elevate private label offerings, and pioneering waste reduction technologies. From digitising supply chains to creating value from food waste, Dutch businesses cut costs and emissions whilst enabling complete transparency from field to shelf. With this combination of scientific excellence and entrepreneurial agility, the Netherlands doesn't just participate in the future of food, it architects it, so you can feed the world better.

'Dutch food innovation combines scientific rigour with entrepreneurial speed - creating solutions that feed people better whilst building a more sustainable future.'

Capturing value in the next decade ahead

Businesses that grasp the full potential of the Feed domain will have the edge in 2035.

The extent of that growth will depend on how megatrends play out.

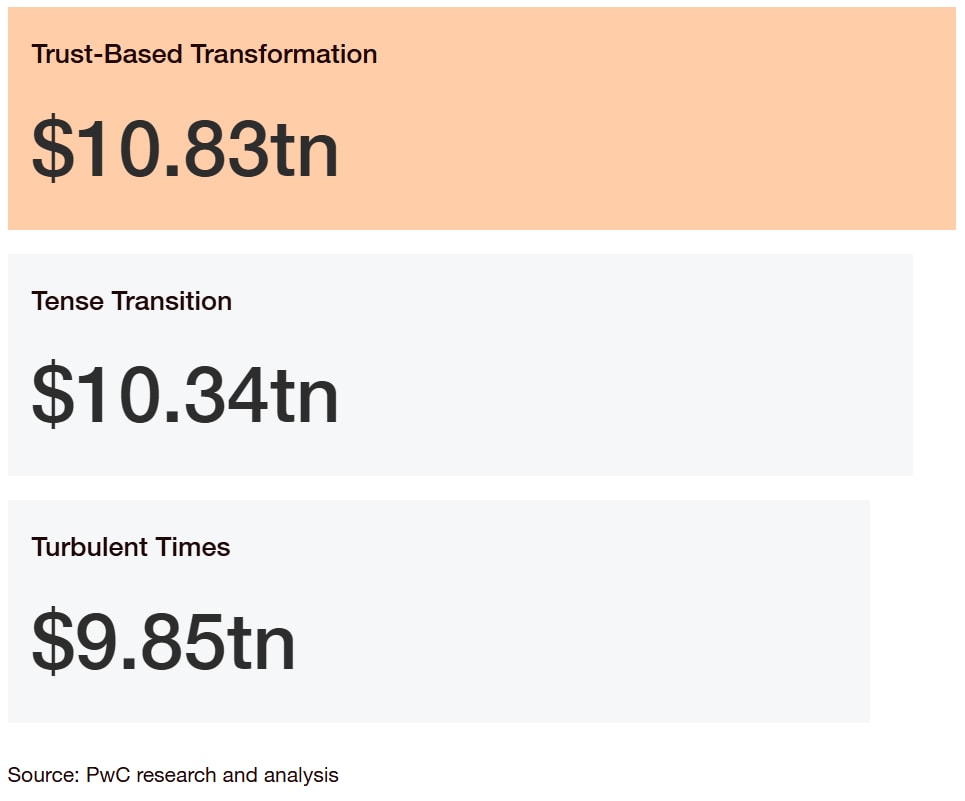

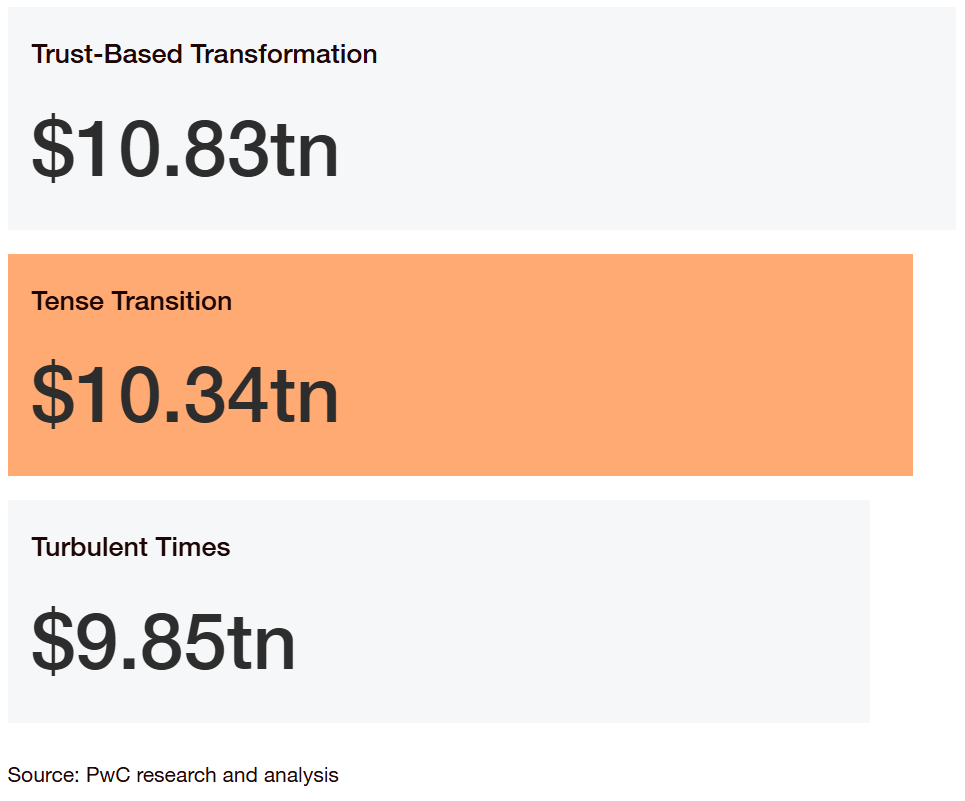

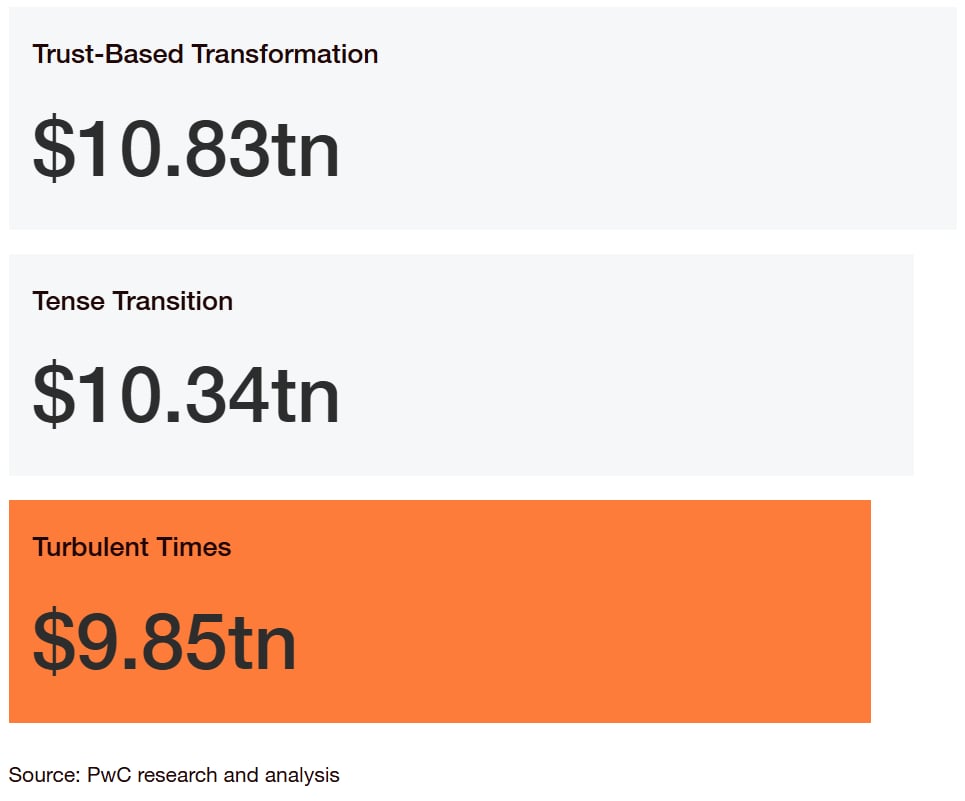

To obtain a quantitative picture of what the Feed domain might look like in 2035, we modelled the potential global economic impact of two of the most pressing megatrends: technological disruption (specifically disruption from AI) and climate change. The result is three divergent scenarios, corresponding to a range of outcomes, from a low of $9.85 trillion to a high of $10.83 trillion.

Sizing the Feed opportunity

The nature and scale of the new business opportunities that emerge in the Feed domain will depend on how AI adoption and climate action progress. Your strategy should account for a range of possible outcomes. Three scenarios can help leaders in the Feed domain consider what the future might bring.

Learn more about the three divergent tomorrows

To reinvent for multiple tomorrows, take action today

The process of reinvention needs to start now, with a focus on priorities that respond to the reconfiguration that’s already underway. This means driving hard towards a set of innovation imperatives, securing competitive advantages in areas such as technology and trust, and turning obstacles such as climate threats into enablers of growth.

How to win in the Feed domain

Explore all new domains

Select from the nine domains below to learn how they are forming, the size of the opportunity and how to seize the value in motion.

Contact us