Unlock the full potential of your transaction with the Netherlands' leading Deals Tax advisor

Deals Tax Services

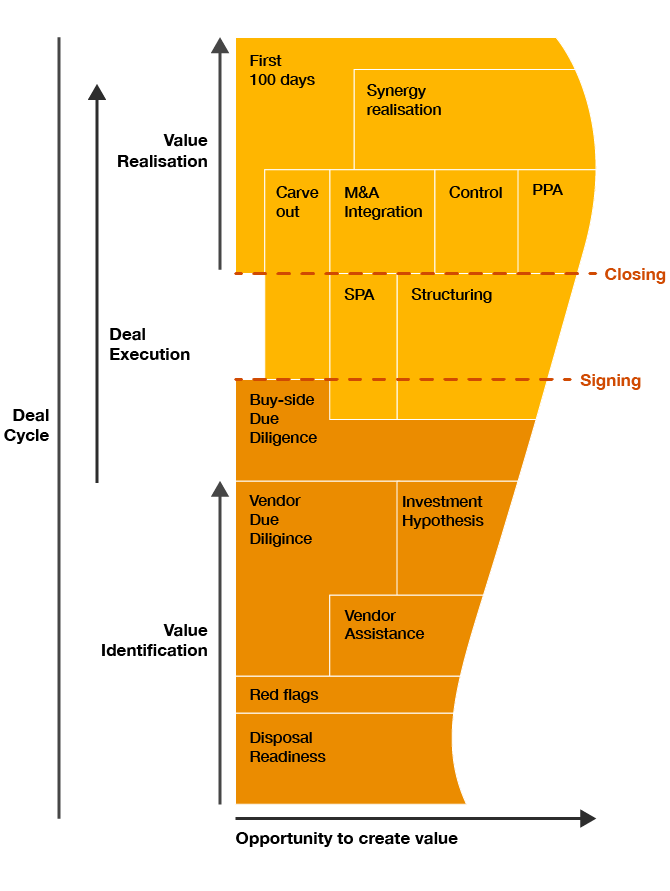

Transactions in the form of M&A, divestments, joint ventures or refinancing drive change. In today's competitive, fast-paced and transformation pressured market, dealmakers need to look beyond the traditional aspects of M&A. Forward looking to create value while preserving the core. Considering financial return as well as social and environmental impact. Dealmakers are not just validating the robustness of a target’s tax position but, they need to consider the tax implications of their investment thesis, i.e. how to create, enhance and protect value throughout the deal lifecycle. That’s what we call end-to-end, and that’s how we support you as a dealmaker.

Whether you are preparing for a deal, executing a divestment or carve-out, managing your investment, or refinancing your business, we can help you identify and manage tax risks, optimise tax outcomes and enhance deal value. Keen to learn more about what we can do for your M&A strategy? Contact us today and let us show you how we can make a difference.

Deals webcasts

Deep dives of tax implications of transactions explained in our State of Tax, Legal & People webcast series.

Deals & Due Diligence - Look back or download the presentation on the webcast page.

Teaming throughout your transaction cycle

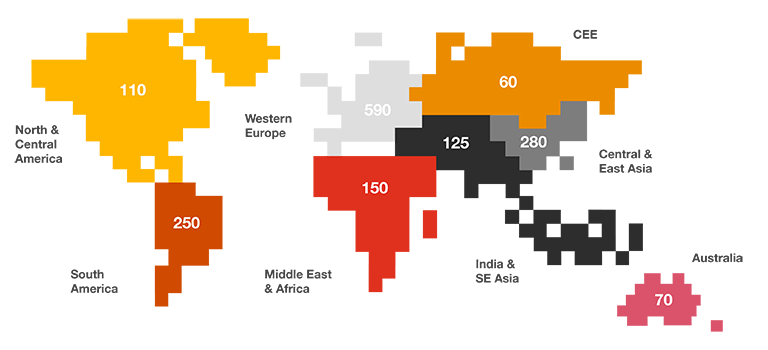

Connectivity is critical in fast-paced and multi-faceted transactions. Teaming helps to close information gaps, and swiftly act on critical interdependencies. We operate as one with you in the form of shareholder, target or investor, your team of advisors. Bringing a combination of skills from a leading pool of transaction tax professionals to navigate and deliver on your transaction thesis.

We guide you in your capacity as a shareholder, target or investor through your transaction. From start to finish and however and wherever you transact. Focusing on value, helping you to identify tax synergies of your divestment and investment thesis and how to protect your position - in price or contract - for any tax contingencies. From determining whether the target is in control and compliant with its tax reporting and compliance obligations and ready for future obligations, to assessing tax risks/opportunities that should be factored into the business’ revenues or cost base, e.g. increased tax shield, transition costs, increased reporting and monitoring costs, related to any changes to the business following the transaction.

Data driven

Go beyond an unfounded narrative when evaluating and validating your transaction. To present a thesis for you and your stakeholders to bank on, hard tax numbers should be put on the as-is and any what-if scenario, e.g. impact of Pillar Two, CBAM, operating model change, revenue and cost synergies. Our approach is data driven allowing you to counter any contingencies and deliver on the sustainable uplift of your investment thesis.

Sustainable playbook

Our playbook goes well beyond typical transaction services. Covering any type of tax relevant to the target and the transaction for instance if the target is exposed to future carbon taxes and carbon pricing, plastic taxes as well as wider tax developments such as carbon border adjustments. Looking back and forward making sure tax is an enabler of your sustainable investment thesis.

Once your transaction is signed it is all about taking control over your tax position and its attributes to preserve value and ensuring business continuity. Managing operational challenges of reskilling the tax function, systems and processes so that it can continue to meet reporting and tax return obligations during and after the transaction. Deploying innovation box, aligning forecasted EBITDA of target operations and financing structure, accelerated tax depreciation, grants and subsidies, simplification of legal entity structure to help you realise your investment and transformation thesis.

Supporting you with expertise that is in sync with your transaction strategy, every step of the way.

Contact us