IFRS 9

International Financial Reporting Standard for the accounting of financial instruments

In 2014 the IASB (International Accounting Standards Board) issued the new standard for the accounting of financial instruments, IFRS 9. The objective of this standard was to improve and simplify the reporting of financial instruments and to address concerns of public and regulators on the ability of such financial reporting to present relevant and useful information at times of a financial crisis. By 2018, IFRS 9 was implemented by the IFRS-reporters, with an exception of insurance companies that qualify for the temporary exemption. IFRS 9 is divided into three main phases:

- Classification and measurement;

- Impairment; and

- Hedge accounting.

Classification and measurement

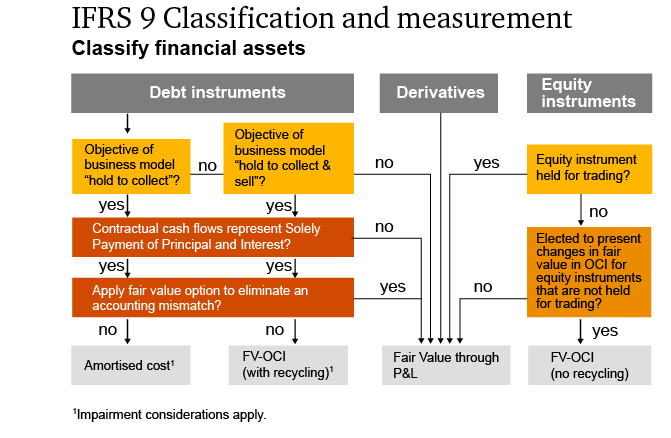

The first phase of the IFRS 9 provides guidance on the classification and measurement of financial instruments. IFRS 9 requires that all financial assets are subsequently measured at:

- Amortized cost, or

- Fair value through other comprehensive income (FVOCI), or

- Fair value through profit or loss (FVPL).

Whether a financial asset is classified as amortized cost, FVOCI or FVPL is mainly based on the business model assessment and the Solely Payments of Principal & Interest (SPPI) test.

The main change in the classification and measurement of financial liabilities is the recognition of changes in own credit risk in other comprehensive income for liabilities designated at fair value through profit or loss.

This might be the least complex area of IFRS 9 but for Banks and other financial institutions with considerable financial assets on their balance sheet, implementation and compliance maintenance of classification and measurement requirements of IFRS 9 came with substantial challenges.

The COVID-19 pandemic and its aftermath, have created many practical challenges in the application of classification and measurement requirements of IFRS 9. Entities should consider the impact of COVID-19 on the classification of financial assets, in particular whether the entity’s business model for managing financial assets might have changed. Additionally, the volatility of prices on various markets has increased as a result of the spread of COVID-19. This affects the fair value measurement of financial instruments either directly, i.e. fair value is determined based on market prices, or indirectly, i.e. fair value is estimated through the application of fair value models. Finally, for both loans held (assets) and debt issued (liabilities), entities should assess the impact of any changes to the terms of a loan such as a payment holiday, whether arising from actions taken by local government or the renegotiation of terms between the borrower and the lender.

Impairment

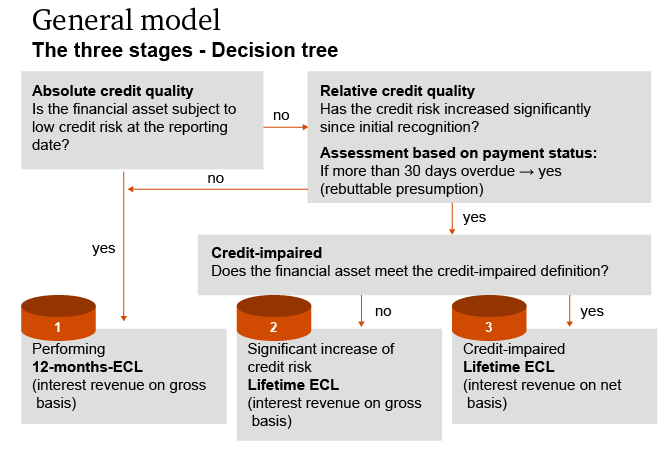

With IFRS 9, a new impairment model was introduced which resulted in earlier recognition of credit losses. The main difference was the change from using an incurred loss model to an expected loss model. IFRS 9 impairment requirements are aimed to provide users of financial reporting with more useful and relevant information about the expected credit losses on financial instruments. With this information issuers and users of the financial reporting can notice financial risks earlier.

Banks calculate expected credit losses (‘ECL’) under IFRS 9 using forward-looking judgements, (statistical) credit risk models and data. As a result of severe economic conditions and uncertainty arising due to COVID-19 and aftermath, entities are facing significant uncertainties in application of the developed impairment methodologies and from potential shortcomings of the models and data. To address these uncertainties, banks need to consider and respond to the implications of these severe economic conditions on the models, methodologies for estimates, accounting policies and the related processes.

Hedge accounting

IFRS 9 provides an accounting policy choice: continue to apply the IAS 39 hedge accounting requirements until the macro hedging project is finalised, or apply IFRS 9 (with the exception only for fair value macro hedges of interest rate risk). Hedge accounting under IFRS 9 can be easier to achieve than under IAS 39. Hedge accounting is still optional but a wider range of instruments qualify as hedging instruments, effectiveness testing is simplified and more things can be hedged.

How can PwC help?

Our team has experience in supporting clients successfully complete the transition to new accounting standards or optimize and improve already executed transition to ensure continuous compliance. We are also at the forefront to you address unexpected challenges to established practices from continuously changing economic and regulatory environment (such as the COVID-19 pandemic and its aftermath). Our flexible and scalable methodology focuses on deep market experience and effective knowledge transfer, in order for our clients to obtain lasting benefits. Examples of support we provide to clients include:

- Technical and accounting advice and support tools

- Optimization and improvement of accounting policies and processes to ensure continuous and stress-prove compliance

- Assessment of the implications of COVID-19 on the classification and measurement processes and policies

- Assessment of the implications of COVID-19 on the impairment models

- Support for developing policies and practices for management overlays (i.e. post-model adjustments)

- Support in IFRS 9 model (re)development and model validation

- Support in model development and model validation

- Support in optimization of processes, data and systems

- Learning and change management support