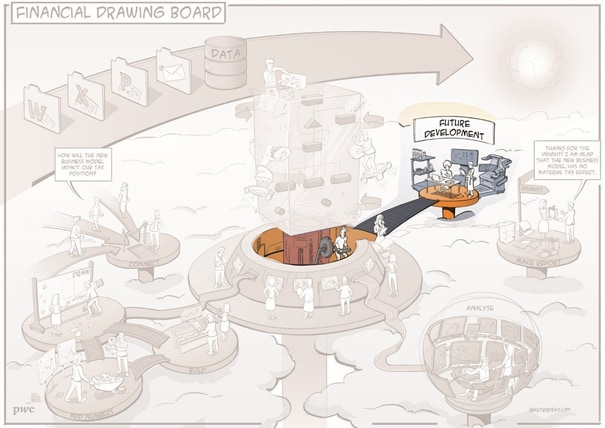

Financial drawing board

How is your organisation influenced by new laws and regulations? Which data will help you to identify this quickly and precisely?

Being better prepared for the future through quantitative analysis

Using impact and scenario calculations, we will conduct a simple, fast and accurate analysis of how, for example, measures included in the new coalition agreement such as the earnings stripping measure, the more limited loss carry-forward and the amended innovation box scheme will influence your tax position.

Models standardised and integrated

PwC has already created hundreds of different models for every conceivable financial and tax analysis. We have improved these models through standardisation and cross-integration by means of quantitative analyses. When your data is added, static information is dynamically created and visualised in all model options.

PwC sketches your current situation on the digital canvas, and makes a forecast or journey through time past the various changes in your organisation. We can visualise and calculate scenarios with financial and tax consequences in no time, providing you with an immediate understanding of the consequences.

Simple data input and output

The models can already be activated with the input of a limited number of basic figures. Scaling up data and models is extremely simple, just like linking large quantities of data. We can export the outcomes of the various scenarios and their associated visualisations to QlikView, Excel or PowerPoint if required.

Better insights, faster decisions

Decisions previously taken based on a handful of calculations and gut feeling can now be corroborated with data. The interaction between all our integrated models allows for analyses that would previously have been too complex. This type of analysis results in faster decisions based on better and more integrated insights. If you want to know more or gain a better understanding of what this application can mean for your organisation, please contact us.

Related content

Contact us