{{item.title}}

{{item.text}}

{{item.text}}

Pillar Two establishes a minimum tax system with a minimum effective tax rate (ETR) of 15% at the jurisdictional level. Companies with global turnover above EUR 750m will be within the scope of Pillar Two. Where the effective tax rate (ETR) is below the agreed minimum, the new system will top up the tax liability so that the overall rate will reach the established minimum in each jurisdiction where the taxpayer is resident.

With respect to the ETR calculation, Pillar 2 introduces two new concepts: The GloBE tax base is the Arm’s length Profit Before Tax from the financial accounts after a number of a significant amount of adjustments and eliminations. The covered tax is the accounting tax actually paid plus and/or minus withholding taxes and a number of other adjustments.

Due to the ongoing influences of geopolitics and the various changes and tightening of regulations from the OECD, we would like to provide you with an update on the latest developments and guidance on how to deal with these in practice. What is the minimum you now need to do to remain compliant?

To get clear insights into how Pillar Two may impact your business, PwC has developed a pilot. The goal of the pilot is to get insight in the Financial Impact of Pillar Two and the Data-Gap and complexity. This insight can be used to prepare an internal business case for Pillar Two.

PwC’s Data Input Catalog is at the centre of PwC’s end-to-end process for Pillar Two. The Data Input Catalog defines the data requirements for Pillar Two, giving MNEs a comprehensive understanding of the amount of work that lies ahead of them and can help MNEs anticipate the unique challenges they will face. Acting as the foundation to develop an extensive data strategy, assess operational preparedness, or determine a modelling approach, PwC’s Data Input Catalog is the core to Pillar Two readiness.

The main rule of Pillar Two is the so-called Qualified Domestic Minimum Top-up Tax (QDMTT) which imposes a top-up tax on a jurisdictional basis in case an entity (or entities) is (or are) not subject to a consolidated ETR of 15% within that jurisdiction. If a jurisdiction does not implement a QDMTT, other countries can impose a top-up tax at the Ultimate Parent via the Income Inclusion Rule (IIR). In addition, the Undertaxed Payments Rule (UTPR) will act as a backstop and will apply where the QDMTT and IIR have not captured the entire top-up tax, including in the jurisdiction of the Ultimate Parent. The IIR and the UTPR are together referred to as the GloBE-rules. If the safe harbour rules apply for the QDMTT, IIR and the UTPR, no full calculations are required under the Globe-rules and/or QDMTT. The UTPR will not apply in case of the UTPR Safe Harbour applies.

The OECD has recommended that the Pillar Two rules become effective in 2024, with the exception of the Undertaxed Profits Rule (UTPR) which is recommended to become effective in 2025. The EU Member States formally adopted the Minimum Tax Directive on December 15, 2022 and Member States should have transposed the Directive into their domestic law by December 31, 2023. For an overview of the status per jurisdiction, please use Pillar Two Country Tracker. On19 December 2023, the legislative proposal of the Minimum Tax Act 2024 was adopted by the Senate. Nevertheless, many multinationals were already subject to Pillar Two since the transition rules capture certain transactions occurring on or after November 30, 2021.

We refer to our Tax news article in relation to the Dutch legislation.

We can help you assess and model the likely financial and operational consequences of Pillar Two.

Pillar Two will have a pervasive impact on an organisation’s financial operating model requiring early stakeholder engagement and substantial budget and resource allocation to address the multitude of challenges. Organisations must ask themselves if their current data model, systems (technology), and processes can support the requirements introduced by this new international tax framework.

We can help determine how to access the financial data needed to comply, identify gaps in the data needed for reporting, and reevaluate operations given the anticipated law changes in many countries.

Identifying the data requirements and developing a comprehensive data strategy should be one of the first steps that taxpayers take in preparation for Pillar Two. The variety of data sources owned by a diverse group of stakeholders makes the collection and synthesization of the data tremendously challenging. Early cross-functional engagement is critical to ensure that the appropriate data and system owners are aware of what will be required under Pillar Two, why it’s important, and how it may impact them going forward.

We PwC professionals can help identify the data requirements and develop a data strategy rooted in systems and processes that can sustain reporting and compliance requirements upon enactment.

We can also help you meet your ongoing reporting, compliance and modelling needs. Pillar Two introduces new compliance and reporting requirements based on new calculation methodologies. While there is some overlap between the data points used for existing reporting and those required for Pillar Two, we recommend undertaking an assessment to confirm whether required data points can be extracted from source systems or whether change requests are required to capture required data.

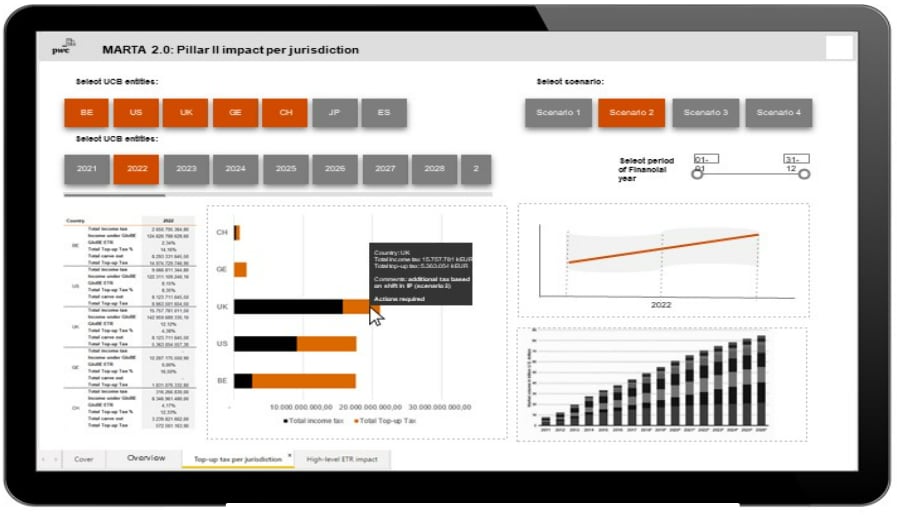

To get initial insights into how the Pillar Two rules may impact your business, PwC has developed the Market Taxation Analyser (MARTA). The tool is part of the pilot impact analysis as described above.PwC’s MARTA tool quantifies and visualises the impact of the Pillar Two rules on your business in various scenarios. The tool is fuelled by your own financial data submitted via an Excel based information request, taking into account the Transitional Safe Harbour, GloBE Rules and Commentary to the GloBE Rules. MARTA forms an important step in testing the applicability of the Transitional Safe Harbour rule and will indicate which countries are part of the Safe Harbour rules and are initially excluded from the detailed Pillar 2 calculations.

PwC’s Pillar Two Engine is a structured model for assessing the impact of OECD Pillar Two, configured to support the inconsistent and unique adoption of Pillar Two rules around the world and allow for flexibility as those rules continue to evolve. Multiple different variations and interpretations of local rules will require an iterative modelling process for Pillar Two calculations. PwC’s Pillar Two Engine is flexible to allow for various data structures/sources. It also prioritises the key adjustments/elections. The modelling provides compliance and provision grade calculations as well as data visualisation to identify key territories where there is a risk of an OECD Pillar Two tax charge.

Our engine utilises a centralised database with a vetted calculation engine in consultation with PwC Global technical and policy leaders. The database is dynamically updated for rule changes and new legislation in each jurisdiction.

{{item.text}}

{{item.text}}