Creating value from divestment processes: Carve-out

Introduction: our view on Carve-outs:

Carve-outs, or divestments, are increasingly more important in the current deal market. By separating businesses, divisions or brands, companies can focus on their core capabilities and maximize their stakeholder value. With our experience of carve-outs from both vendor and acquirer perspective, we can help to prepare and implement these strategic initiatives.

We can support clients across all phases of the deal continuum

- How do we prepare a carve-out plan that minimizes business disruption and ensures the carve-out business is operational on Day 1?

- How can we quantify the recurring and one-off financial impact of the separation?

- How do we define and prepare an efficient standalone operating model for the carve-out business?

- How can we get maximum value from our optimization plans and deliver this value through implementation?

Support: how we can solve your carve-out challenges

Our proven approach enables parties to prepare, design and execute carve-outs and minimize business disruption in the execution.

We have the right people and capabilities to advise the client from the decision to divest the business to the change of control of the perimeter, and beyond.

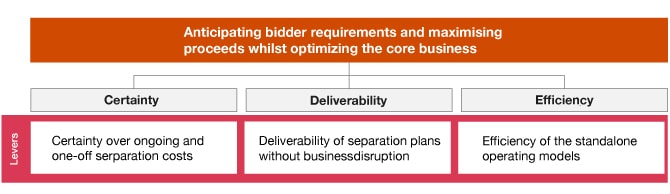

Our approach is designed to maximize clients return

- The success of carve-out projects is dependent on the chosen strategy and the structure of the process

- Our approach is designed to maximize clients return

- Several value creation levers can be activated. A structured plan needs to be set up to identify priorities

- A value creation journey is expected to positively impact all valuation variables: Sales, EBITDA, Cash and Exit Multiples

Support for vendors and acquirers - How we can help you

- Vendor

- Acquirer

Vendor

If you’re a vendor, you want to focus on your core business, minimize the impact from the separation process and get the most value out of the transaction. This includes deal value for the carve-out business, but also optimization of the remaining parent organization.

We work shoulder-to-shoulder with you to support with:

- Assessing the applicable one-off and recurring costs of the separation

- Anticipating bidder requirements throughout the due diligence phase

- Setting up deliverable separation plans that minimize business disruption

- Executing the transition of the carve-out business to becoming a NewCo

- Advising on how to optimize your remaining core operations following the separation

Acquirer

If you’re an acquirer, you need to be able to fully understand the structure of the carve-out and its financial implications whilst at the same time feel convinced that the vendor is able to deliver on its carve-out plan. We can provide you with the required certainty throughout the carve-out due diligence. Post-signing we can help you to maximize returns from the value creation plan. We will work together closely with you and the vendor to implement these complicated processes effectively.