Historical overview of risks provides new insights

Historically, global epidemics that infected large numbers of people, occurred more often in the eighties and nineties of the previous century than in recent years. In the last decade, however, we have seen more outbursts of epidemic diseases, such as currently the Coronavirus, than in the first half of the twentieth century. But the impact of these outbursts in terms of people affected and lives lost seems declining.

Four global risk categories

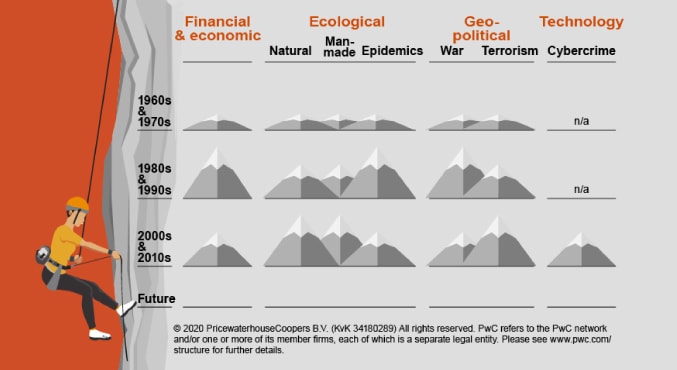

PwC’s report A Short History of Risk identifies four global risk categories - financial and economic, ecological, geopolitical, and technology risks. The report sheds light on the evolution of these risk categories, assesses whether recent risk levels are higher or lower compared to historical figures, and concludes with a glance into the future.

Is the world becoming a riskier place?

‘It seems to many that the world is becoming increasingly risky. Much of that may be because impactful events increasingly make the headlines, so we simply hear more of them. It may also be the consequence of our denser global population, where events simply affect larger populations’, says PwC's chief economist Jan Willem Velthuijsen. ‘It is useful to take a closer historical perspective to see if our intuition of an ever riskier world is true or not.’

Coronavirus

‘The recent outbreak of the Coronavirus illustrates this. Now, this virus and the infected people draws a lot of media attention, instantaneously and across the planet. No outbreak is the same as the previous one, so comparisons are tricky. The immediate, quite radical, response by authorities is different now, as is the media response.If we look at the data in our report, we see a downward trend in the impact of pandemics. This could indicate that we have become better at containing outbreaks.Of course we have to wait and see if this trend will continue.’

Financial crisis

We argue that our Short History of Risk shows that the global financial crisis of 2008 and its aftermath have not marked the riskiest period in terms of financial and economic risks; the 1980s and 1990s have. But at the same time the trend is that banks are to be more heavily regulated, while systemic risk is shifting to non-bank institutions.

Other outcomes

Other outcomes from A Short History of Risk: Occurrences of natural disasters stand at nine times the levels seen in the 1960s and 1970s. Instances of armed conflicts between the government of a state and internal opposition groups with intervention from other states have increased. Terrorism risk is at a record high, with Middle East and North Africa, South Asia, and Sub-Saharan Africa suffering more than ninety percent of the fatalities.

Cyber risk, the newest of the risks under analysis, shows that web, app, government, and retail sectors are the most affected by cybercrime.

Financial sector

While these global risks affect all organizations across industries and geographies, this report especially focuses on financial sector (FS) entities. The interconnectedness of risks, their far-reaching impact, and the criticality of trust and investor confidence in the FS sector make this sector particularly vulnerable. The four global risk categories analyzed in the report have repercussions for different aspects of the business of FS entities, including investment returns, payouts on liabilities, geographic expansion plans, traditional risks captured by prudential requirements, and the reputation of these entities. Jan Willem Velthuijsen: ‘It makes sense for FS entities to base their strategic decision-making on a holistic approach to risk management that includes an explicit consideration of each of these four global risk categories, in addition to FS-specific risks.’

Contact us