By 2027, the European last mile delivery market is expected to nearly double compared to 2022. E-commerce growth shows no signs of slowing down, although it is faced with many challenging dynamics: more players are entering the market, the Covid-pandemic seems to have changed the rules of the game permanently, and even as customer-oriented services like sustainable delivery are becoming more important, delivery vans still line the streets on a daily basis. The industry seems to be at the verge of a paradigm shift, and the million-dollar question is: how will continued growth and societal trends transform last mile delivery for retailers and consumers?

The PwC Retail Monitor 2023 explores the current state-of-play of last mile delivery1 and provides directions for the future based on four success factors:

- Accuracy – delivering the right order at the right time to the right location;

- Speed – delivering to the customer within the shortest time after order placement;

- Convenience – providing additional services that are aimed at making the delivery process more customer-oriented; and

- Profitability – improving revenue while decreasing costs.

The Retail Monitor is data-driven annual research performed together with over 50 retailers from various subindustries whose financial data and view on last mile delivery are used to build industry insights. This year, we also included an order study as an extra research component to add the consumer perspective. This order study collected consumer feedback based on their experiences with last mile delivery of their orders. Altogether, these findings and perspectives make up the Retail Monitor 2023.

The bottom line is that in the post-pandemic retail environment, accuracy gets priority over speed. Retailers will win if they can achieve a perfect balance between managing and meeting expectations of delivery time, location and convenience. These and other conclusions of the PwC Retail Monitor 2023 are summarized in the animation.

Retail Monitor 2023 video – Last mile delivery

1Last mile delivery is the last leg of the delivery process of moving goods from distribution hubs to the customer. Inherently, many stakeholders and handovers are involved in this process, all with the ultimate goal of satisfying the customer with a successful delivery and smooth customer experience.

Accuracy - is achieved when the retailer delivers the right customer order at the right time to the right place

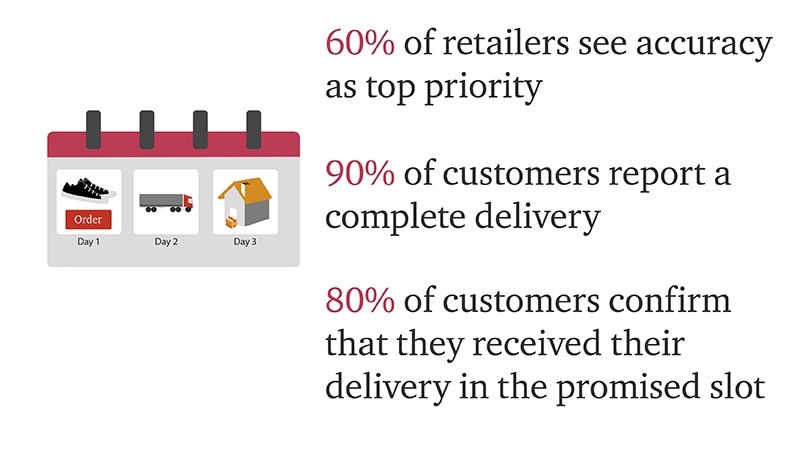

Retailers put accuracy at the top of their to-do list, by far: sixty per cent indicate that this is top priority for them. Customers, too, prefer accuracy over speed. This drive to achieve higher accuracy forces retailers to both manage and meet expectations. Managing expectations can be done by clearly communicating about delivery time, location and any other services (such as mode of delivery) and by clearly communicating about any changes during the process. Our research shows that even if the order is not delivered as fast as possible, customers are still happy when their expectations are being managed and met.

However, our research also shows that achieving this is not easy. We measured the ‘on time in full’ (OTIF) percentage of deliveries. While ‘in full’ deliveries are achieved in the majority of cases (ninety per cent of customers report a complete delivery), delivering ‘on time’ tends to be more challenging (twenty per cent of customers report that their delivery was not received in the promised slot). The grocery market sets an example for the rest of the retail industry. This is the most reliable subindustry coming out of our study: customers report that grocery retailers meet their promised delivery time and date in almost all cases.

Key insights:

A great way for retailers to set expectations is time slot planning, and here we see large differences across subindustries. Where grocery retailers offer accurate time slot planning, retailers in many other subindustries do not offer this possibility to customers. For example, only half of the electronics and technology retailers offer time slot planning. In apparel, it varies between selecting a timeslot or not offering a time slot at all (2 to 3 working days is often only mentioned).

Communication is key to managing expectations throughout the delivery process. Even when retailers are not fully accurate in their delivery, customers can still have a good delivery experience if changes or updates are communicated transparently. Above seventy per cent of the retailers do so by informing their customers about delays. Sharing a track-and-trace has become the standard across all subindustries: the customers’ expectation is to receive a track-and-trace for their order.

Speed – is achieved when the time between the customer order placement and the delivery of the order is minimized

Key insights:

- Speed is customer- and product-need dependent;

- Food and grocery retailers perform best on speed;

- Although speed is not the top priority, it can be a “winner” if all other offerings are equal;

- The majority of retailers place emphasis on accuracy as it is more important to deliver within a promised time frame.

Gone are the times where speed is the one and only important factor in delivery. Speed is customer- and product-need dependent. This means that speed is no longer the distinctive factor in a successful last mile delivery. However, customers do make a distinction between the type of product and whether or not they need it right away. A heavy closet at a furniture store can wait, but clothing items are often desired the same or next day.

A good example of an industry where speed is still top priority is the food and grocery market: retailers here still rank speed as their top priority. This is partly due to the perishable nature of their goods, as (prepared) food cannot wait indefinitely to be delivered. But during the Covid-pandemic, customers were encouraged to avoid shops and could not visit restaurants, therefore, many ordered groceries and food to their homes. This behavior has remained post-pandemic and fast deliveries in the food and grocery market are still highly valued by customers. However, subindustries outside the food and grocery market have shifted their priority away from speed and towards other delivery factors.

In Europe alone, more than 150.000 companies are selling goods and services through e-commerce, increasing the number of choices that customers have. This means that the customer often has multiple companies offering the same product. That allows customers to now include the weighing of delivery time against many other options. Therefore, speed can be a “winning” competitive factor when all other offerings are equal.

For only nineteen per cent of retailers, speed is the most important delivery factor, while for a further 32 per cent speed is scored as second highest priority. Some retailers even indicate to have stopped at-home deliveries or reduced the overall delivery channels available to focus on improving speed performance. But generally, speed is not a differentiator. This means that when goods are delivered in the promised timeframe, no increase in performance perception is recorded, while if delivered outside of the promised timeframe – earlier or later – the customer performance perception decreases. This makes it difficult for retailers to increase the overall performance perception of customers with speed alone. This results in the conclusion that retailers should work towards delivering within the promised time frame.

Convenience – is achieved by making the delivery process more customer-oriented by providing additional services

Customers no longer base their delivery process satisfaction solely on accuracy and speed. Now it is of greater importance that retailers also focus on providing a customer-oriented and convenient experience. The order study shows that additional efforts, such as special packaging or a hand-written note, resonate positively with customers. Similarly, excessive packaging is perceived negatively by customers. Both factors impact customers’ satisfaction even if it is only a small part of the overall delivery experience.

Although reverse logistics are a separate area of focus, a delivery is at the start of the return process as retailers decide whether to provide return labels and/or return forms. By including return materials, they are increasing customers’ convenience in the order process. When asked whether their delivery contains a return label and/or return form, more than fifty per cent of the customers reported that the retailer did not provide either. However, customers find this added service very important and convenient. Retailers are, therefore, recommended to better facilitate the start of the return process.

Key insights:

Convenience is also impacted by societal pressure for sustainability. Our research shows that only 25 per cent of the retailers offer the choice for a sustainable delivery option, showing that there is an opportunity for retailers to grow in this area. Some retailers already do this by offering the option of delivery by bike. Aside from offering sustainable delivery options, retailers also need to make the impact of sustainable options clearer. For many customers, it is unclear what impact they can make by choosing a sustainable delivery option. For example, paying an additional 25 cents to offset CO2 emissions in the delivery process does not give the customer a clear understanding of what will happen with the 25 cents.

Increasingly, residents complain when multiple delivery carriers block the street throughout the day. Thus, order consolidation – grouping different individual items from a single order into one single shipment – stands out as a highly valued service for customers. Not only does this limit traffic and increase convenience for the customer as the deliveries for an order are bundled into one, but it is also makes deliveries more environmentally friendly. Currently, only about half of retailers’ orders are consolidated.

Profitability – is achieved by improving retailer revenue while decreasing costs

Key insights:

- Profitability is the lowest priority in last mile delivery;

- However, there is a strong business case for this: retailers in our research indicate that the majority of their orders are fulfilled through last mile delivery;

- Improving profitability requires making more strategic choices about your delivery model.

Profitability in last mile delivery appears not to be a priority. Only thirteen per cent of retailers in the study indicate that they prioritize this factor over the other three. For years, retailers have been struggling with incorporating the growing demand for delivery into their business model. During Covid lockdowns, delivery meant a continuation of sales while stores were closed. But now that the pandemic lockdowns are over, it seems delivery will continue to be the largest sales channel while the role of brick-and-mortar stores has remained. Our (post-Covid) study shows that around seventy per cent of the retailers indicated that the majority of their orders are fulfilled through last mile delivery. This new balance calls for re-thinking the finance of delivery. Delivery triggers no direct revenue, therefore, optimizing its profitability should be done by reducing or compensating costs, or by triggering indirect revenue.

Take two examples from the on-demand grocery subindustry. Various players in the subindustry are aggressively fighting for as many customers as they can get. For them, economies of scale are the only way to ease the high costs of delivering within 10 minutes. Many of these companies have yet to find their way to profitability. Similarly, larger established grocery stores have successful grocery delivery programs but lock their customers in with at least a 12-month commitment to the program – securing more revenue indirectly.

Of course, a focus on creating speed, accuracy and convenience will make customers happy and loyal to you, thereby also securing revenue streams. But is this enough? Our research shows that some retailers make more drastic choices. In our study, six per cent of the retailers indicated they do not offer any delivery services because it does not suit their strategy. Other retailers charge for (return) shipment which can make up for part of the delivery cost. These measures seem like a more strategic and economically sustainable solution to remain competitive, rather than absorbing the cost of delivery into your product margin. The new industry balance calls for new strategies.

How will continued growth and societal trends transform last mile delivery for retailers and consumers?

For retailers, the top priority for last mile delivery is to successfully manage and meet customer expectations. While that may remain constant, all other aspects of last mile delivery have and will continue to adapt to the changing environment. In the coming years, convenience, sustainability and profitability will set apart retailers in the last mile delivery space.

To conclude

To effectively manage and meet customer expectations, door-to-door deliveries will make space for more community-based last mile deliveries. This will result in increased collaboration across retailers and third-party logistics providers to increase accuracy, speed, convenience and profitability of last mile deliveries. Food for thought to - not only remain focused on managing and meeting customers’ expectations - but also to ensure to remain relevant and profitable at the same time. A challenge ahead for the retailer of the future.

Like to be part of next year’s Retail Monitor’s scope?

Advice for the retailer of the future

We gained insights and strengthened our research by surveying participants of the DELIVER network of retailers about their experiences, ambitions and views on the future.

Contact us